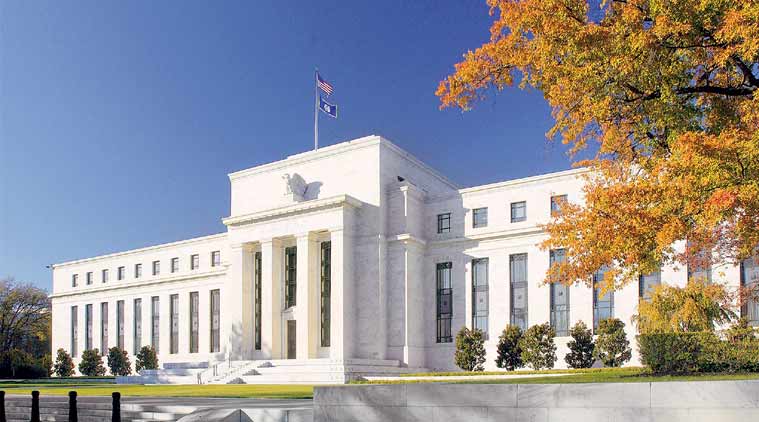

Federal Reserve finds biggest US banks strong enough to survive shock

The first round of the central bank's annual stress tests, released Thursday, shows that as a group, the 35 big banks have benefited from a steadily recovering economy to gain strength and build up capital buffers against unexpected losses.

All the banks can now amend their plans on dividend payments and stock buybacks to win Fed approval before it announces its decisions on those issues next Thursday.

The Federal Reserve says that all of the 35 largest US banks are fortified enough to survive an economic shock and keep on lending. Banks’ hypothetical losses from credit cards increased in the latest “stress tests,” however.

The first round of the central bank’s annual stress tests, released Thursday, shows that as a group, the 35 big banks have benefited from a steadily recovering economy to gain strength and build up capital buffers against unexpected losses. It was the eighth annual check-up for the banks, mandated by Congress after the 2008 financial crisis that triggered the Great Recession.

The Fed said it applied its toughest-ever “severely adverse” scenario for the economy in this year’s tests to see how the banks would fare. The hypothetical scenario calls for a severe global recession and a US unemployment rate of 10 per cent, compared with the current 3.8 percent. The stock market plunges 65 percent by early 2019 amid surging volatility under the scenario.

The banks included JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo and Co. _ the four biggest U.S. banks by assets. The tested banks all have at least $50 billion in assets; together they represent about 80 percent of the assets of all banks operating in the U.S. They were tested to determine if they have sufficient capital cushions, even if hit with billions of dollars in losses brought on by a financial crisis and severe global recession.

The “severely adverse” scenario showed a total of $113 billion in projected losses from credit card loans for the banks, up from $100 billion in last year’s tests. In addition, the sweeping new tax law enacted late last year hurt test results for some banks, by reducing their capital because of accounting changes. Those were one-time declines, Fed officials said. Some banks also lost some tax benefits under the law, reducing their capital in the tests.

Overall, despite the tougher test scenario and the impact of the tax law, the hypothetical capital levels of the banks “are higher than the actual capital levels of large banks in the years leading up to the most recent recession,” Fed Vice Chair Randal Quarles, who is the central bank’s supervision chief, said in a statement.

It was the third straight year that all the banks tested showed the minimum levels of capital.

The tests were mandated by Congress in the wake of the crisis that plunged the U.S. into the worst economic downturn since the Great Depression of the 1930s. They were designed to restore badly shaken confidence in the U.S. financial system. During the crisis, the government created a $700 billion bailout fund to stabilize hundreds of banks, large and small, across the U.S.

Nearly a decade later, banking industry profits have been steadily rising and banks have been lending more freely.

The most critical tests for the industry come next week. That’s when the Fed will announce whether it has approved banks’ requests to increase dividends or buy back their shares. Those results will be based on how each bank would perform in a severe recession if it took those dividend or stock actions.

The tests compare the losses projected for each bank with its capital reserve. The Fed said Thursday that under the “severely adverse” scenario, the 35 banks would suffer combined loan losses of $578 billion. That’s up from $383 billion in losses for 34 banks last year. The Fed said the losses would reduce the banks’ high-quality capital from 12.3 percent of its loans’ value in the fourth quarter last year to a hypothetical 7.9 percent at the end of 2018. That level is below last year but far above the 5.5 percent that the banks held at the start of 2009, soon after the crisis hit _ the year the first stress tests were conducted.

All the banks can now amend their plans on dividend payments and stock buybacks to win Fed approval before it announces its decisions on those issues next Thursday. Increasing dividends costs money and the government doesn’t want banks to shrink their capital reserves, making them vulnerable in another recession.

In last year’s second round, the Fed gave Capital One’s plan only conditional approval and six months to revise it. But the bank was still allowed to return profits to shareholders with dividends. All the other banks received a full green light to raise their dividends and buy back shares, and most of them quickly signaled their plans to do so.

The banks tested by the Fed are: Ally Financial, American Express, Bank of America, Bank of New York Mellon, Barclays, BB&T, BBVA Compass, BMO Financial, BNP Paribas, Capital One, Citigroup, Citizens Financial, Credit Suisse, Deutsche Bank, Discover, Fifth Third, Goldman Sachs, HSBC, Huntington Bancshares, JPMorgan Chase, KeyCorp, M&T, Morgan Stanley, MUFG, Northern Trust, PNC, Regions Financial, Royal Bank of Canada, Santander, State Street, SunTrust, TD Group, UBS, U.S. Bancorp, and Wells Fargo.

For all the latest Business News, download Indian Express App

No hay comentarios:

Publicar un comentario